Stock Market 101: How Beginners Can Start Investing

Stock market mistakes beginners should avoid can silently destroy wealth if new investors act without proper knowledge or planning.The good news is that you don’t need a finance degree or years of experience to start investing. With the right knowledge, discipline, and strategy, anyone can begin their investment journey confidently.

This guide explains the basics of the stock market and provides a clear roadmap for beginners to get started the right way.

What Is the Stock Market?

The stock market is a platform where shares of publicly listed companies are bought and sold. When you buy a stock, you are purchasing a small ownership stake in that company. As the company grows and becomes more profitable, the value of your shares may increase, allowing you to earn returns.

Returns from stocks generally come in two ways:

- Capital appreciation – when the stock price increases

- Dividends – periodic payments made by some companies to shareholders

Why Should Beginners Invest in the Stock Market?

Many beginners keep their savings in bank accounts or fixed deposits, which often fail to beat inflation. Investing in stocks helps your money grow faster over time.

Key benefits include:

- Wealth creation over the long term

- Protection against inflation

- Compounding returns

- Opportunity to own successful businesses

Starting early is crucial. Even small monthly investments can grow significantly over time due to compounding.

Basic Stock Market Terms Every Beginner Should Know

Before investing, it’s important to understand a few basic terms:

- Stock/Share: A unit of ownership in a company

- Index: A group of top stocks that represent market performance

- Bull Market: When markets are rising

- Bear Market: When markets are falling

- Portfolio: A collection of investments owned by an investor

- Risk: The possibility of losing money

Understanding these terms builds confidence and helps you make informed decisions.

How Beginners Can Start Investing: Step-by-Step

1. Set Clear Financial Goals

Ask yourself why you want to invest. Is it for retirement, buying a home, or long-term wealth creation? Your goals will determine how much risk you can take and how long you should stay invested.

2. Build an Emergency Fund

Before investing, ensure you have savings that cover at least 3–6 months of expenses. This prevents you from selling investments during market downturns due to financial emergencies.

3. Open a Trading and Demat Account

To invest in stocks, you need:

- A Demat account to store shares electronically

- A Trading account to buy and sell stocks

Choose a reliable broker with low fees, good customer support, and an easy-to-use platform.

4. Start With Simple Investments

Beginners should avoid complex trading strategies. Instead, start with:

- Large, well-established companies

- Index funds or ETFs

- Companies with consistent earnings and strong fundamentals

These options reduce risk while helping you understand how markets work.

5. Invest Regularly, Not Emotionally

Markets move up and down. Beginners often panic during market falls or get greedy during rallies. Successful investors stay disciplined and invest regularly, regardless of short-term market movements.

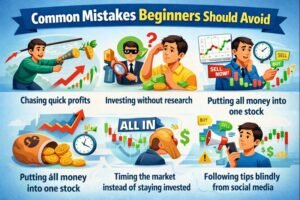

Common Mistakes Beginners Should Avoid

- Chasing quick profits

- Investing without research

- Putting all money into one stock

- Timing the market instead of staying invested

- Following tips blindly from social media

Avoiding these mistakes can save you from unnecessary losses.

How Much Money Do You Need to Start?

You don’t need a large amount to begin investing. Many platforms allow you to start with small investments. The key is consistency, not the amount. Regular investing over time matters more than investing a lump sum once.

Long-Term Mindset Is the Key to Success

Stock market investing is not a get-rich-quick scheme. It rewards patience, discipline, and long-term thinking. Historically, investors who stayed invested for years benefited more than those who tried to time the market.

Focus on learning, reviewing your portfolio periodically, and staying invested through market ups and downs.

Final Thoughts

The stock market may seem intimidating at first, but once you understand the basics, it becomes a powerful tool for financial growth. Start small, stay disciplined, keep learning, and invest with a long-term mindset.

Remember, every successful investor was once a beginner. The best time to start investing was yesterday—the next best time is today.

References

https://www.jmfinancialservices.in/blogs-and-articles/7-common-stock-market-mistakes-that-every-investor-should-avoid

Leave a reply Cancel reply

More News

-

The 10 Most Beautiful Churches in Vienna, Austria

May 27, 2018 -

A$AP Rocky’s New Album ‘Testing’ Is Here: Listen

May 27, 2018

Most Views

Editor Picks

-

How Beginners Can Start Investing

May 27, 2018 -

AI & Tech Stocks: Why 2026 Is Their Year

May 27, 2018 -

Building Wealth with Passive Income

May 27, 2018

Random Posts

Categories

- Architecture (2)

- Beginner Investing (2)

- Design (2)

- IPO & New Listings (4)

- Lifestyle (2)

- Long-Term Investing (3)

- Market Trends & Analysis (2)

- Movies (2)

- Music (1)

- Sport (1)

- Technology (2)

- Travel (2)